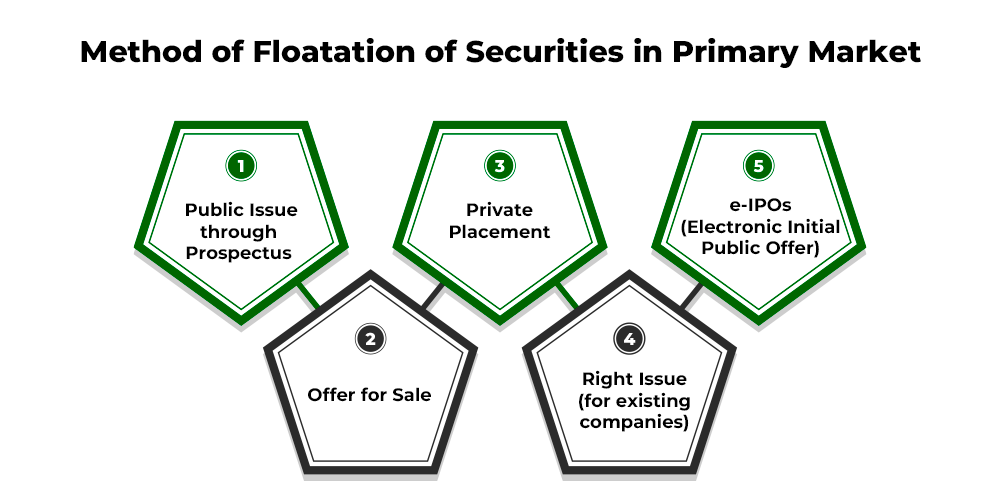

Method of Floatation of Securities in Primary Market

One can issue the securities in the primary market with the help of the following methods:

i) Public Issue through Prospectus

The first method of floatation of securities in a primary market is ‘Public Issue through Prospectur’. Under this method, a company issues a prospectus to inform the general public and attract them to invest in the company. The prospectus of a company contains information regarding the purpose for which it wants to raise funds, its past financial performance, its background, and future prospects. The information provided in the prospectus helps the general public, get to know about the earning potential of the company and the risks involved in investing in the company. Based on this information, the public decides whether or not they want to invest in the company. With the help of an IPO, a company can easily approach a large number of persons and can approach the public at large. Sometimes under this method, the companies take help of the intermediaries like underwriters, brokers, and bankers for raising capital from the general public.

ii) Offer for Sale

The second method is ‘Offer for Sale’ and under this method, the new securities are offered to the general public not by the company directly, but by an intermediary who has bought a whole lot of securities from the company. These intermediaries are generally the firms of brokers. As the intermediaries offer the new securities to the general public, the company is saved from the complexities and formalities of issuing the securities directly to the public.

The sale of securities through Offer for Sale takes place in two steps:

- Firstly, when the company issues the new securities to the intermediary at face value.

- Secondly, when the intermediaries issue securities to the general public at a higher price with the motive of earning profit.

iii) Private Placement

It is a method in which a company sells securities to an intermediary at a fixed price, and then the intermediaries sell these securities to selected clients at a higher price instead of the general public. The company issuing securities issues a prospectus providing details about the objective and future prospects of the company so that the reputed clients will prefer to purchase the securities from the intermediary. The selected clients to whom securities are issued by the intermediaries are LIC, UTI, General Insurance, etc. As the company does not have to incur expenses on manager fees, brokerage, underwriter fees, the listing of the company’s name on the stock exchange, agent’s commission, etc., it is considered as a cost-saving method. This method is preferred by small-scale companies and new companies that cannot afford to raise funds from the general public.

iv) Right Issue (For Existing Companies)

Under this method, new shares are issued to the existing shareholders of a company. It is known as the right issue because it is the pre-emptive right of the shareholders that the company must offer them the new issue of shares before subscribing them to outsiders. The existing shareholders have the right to subscribe to the new shares in the proportion of the shares they already hold.

The Companies Act, 1956 states that it is compulsory for a company to issue a Right Issue to the existing shareholders. It means that the stock exchange does not allow a company to issue new shares in the market before giving the pre-emptive rights to the existing shareholders. It is because if the company directly issues the new issue to the new subscribers, then the existing shareholders of the company may lose their share in the capital of the company and cannot have control over the company.

v) e-IPOs (Electronic Initial Public Offer)

A new method of issuing securities in which an online system of stock exchange is used is known as e-IPO. Under this method, a company appoints registered brokers to accept applications and place orders. The company which is issuing the security has to apply for the listing of its securities on any exchange. However, it cannot be the same exchange where it has earlier offered its securities. For this method, the manager coordinates the activities with the help of various intermediaries connected with the Issue.